BST And BSTZ: Tech Still Has Appeal, BSTZ Looking Attractive

[ad_1]

da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on July 22nd, 2022.

BlackRock Science and Technology Trust (NYSE:BST) and BlackRock Science and Technology Trust II (NYSE:BSTZ) are two funds that I regularly follow. I own both, and I’ve covered more of the basics of the funds in a previous article. I won’t cover that whole topic again. Instead, today we’ll look at more of an update on how these funds have been doing.

One of the biggest differences was that BST had traditionally invested in mostly larger, more well-established companies.. BSTZ had more of a tilt toward speculative and private names. This difference has become less pronounced as they moved BST into more speculative names as well. Still, several of the large mega-cap names remain. That hasn’t provided too much solace to the fund, though, as it has been experiencing strong losses regardless.

Performance Comparison

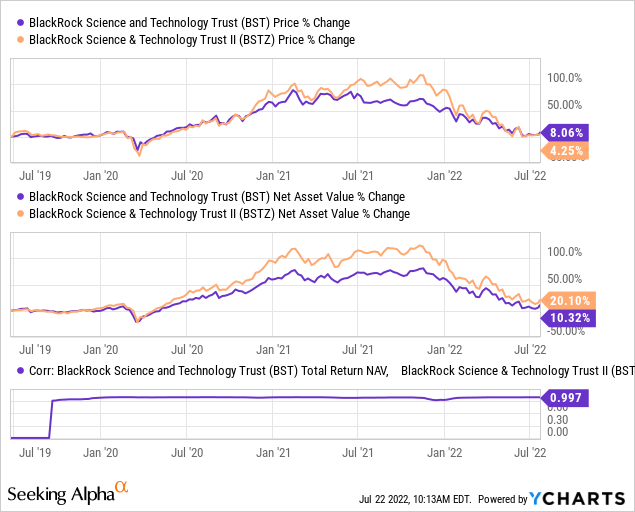

Here is a look at the performance of the price and NAV of the funds since BSTZ’s launch. This chart does not show the impacts of the distribution (i.e., it is NOT showing total returns.) The correlation metric is also provided, showing a significant correlation.

Ycharts

This differs from what we exhibited in BlackRock Health Sciences Trust (BME) and BlackRock Health Sciences Trust II (BMEZ). In the case of those funds, there was actually some material difference that resulted in a relatively more meaningful reduction in correlation. For those two funds, we provided examples of what other funds had provided higher correlations.

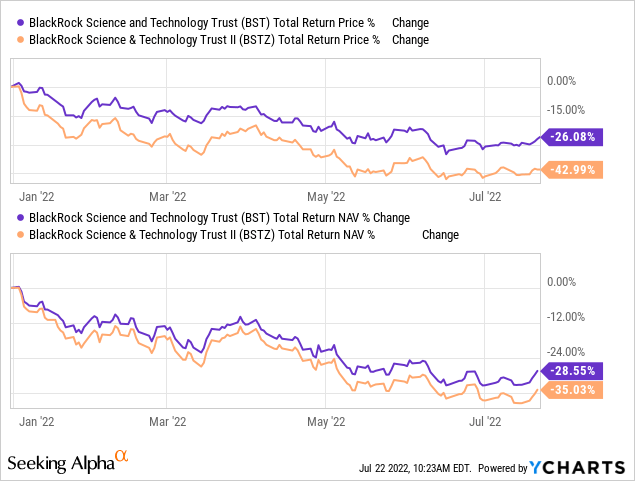

Going back to BST and BSTZ, we can take a look at the YTD performance. Both funds have experienced some sharp losses on a total NAV return basis. The total share price returns have diverged quite materially. That’s what presents a better opportunity for swap candidates.

Ycharts

In the case of BSTZ, the fund’s share price has fallen more rapidly than the fund’s NAV return. Of course, that opens up a discount for the fund. It is precisely what we are looking for when wanting to invest in closed-end funds.

On the other hand, BST’s share price has performed better than its NAV. That has resulted in the opposite of what we want to see. At least the opposite of what we want to see if we are looking to invest in a fund. For shareholders already in the fund, it can be beneficial.

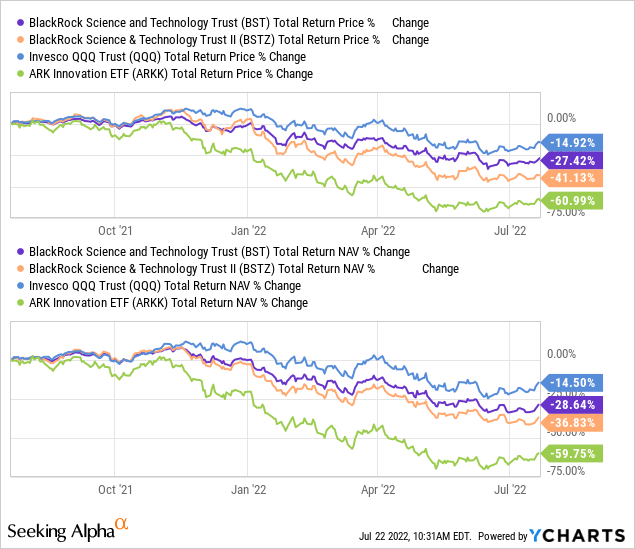

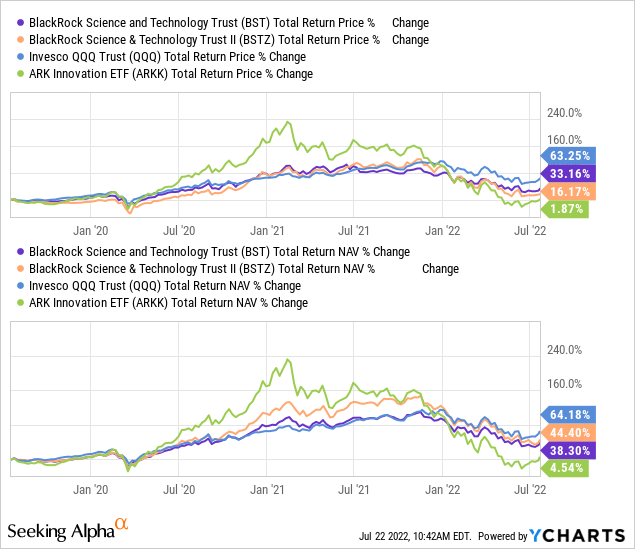

One last comparison I wanted to include was the relative performance of BST and BSTZ to some similar ETFs. For this, we will use Invesco QQQ (QQQ) – a proxy for the Nasdaq 100. This holds a lot of other non-tech-type holdings but can provide some context. We will also use ARK Innovation (ARKK) because ARKK holds a lot of smaller and speculative companies that are associated with BSTZ’s portfolio.

In this case, we can see that ARKK has done the worst by a long shot. We can also see that QQQ has held up relatively better, thanks presumably to the holdings outside of tech.

Ycharts

Even if we go further back, the plunge in ARKK has now been so deep and rapid that BST and BSTZ are still better performing. Some of the defensiveness here can be due to the options writing that the funds undertake. However, the largest factor is going to be the positions of the funds overall.

Ycharts

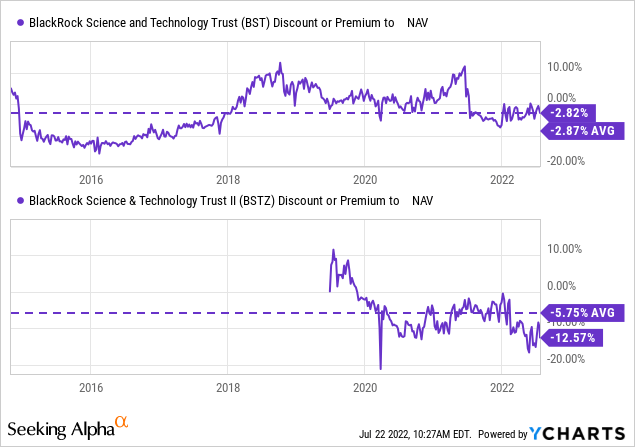

Discount Comparison

BST has a longer history than BSTZ. Going back to a launch in 2014, with BSTZ having launched in 2019. That gives us significantly less of a track record when looking at the discount history for BSTZ.

What history we do have would suggest that at this time, BSTZ is quite a compelling valuation. BST is right near its historical average. That would suggest that it isn’t necessarily a strong buy or a strong sell, more of a hold or neutral rating. That being said, we can see that shortly after the fund launch until around 2018, the fund’s discount was rather persistent.

Ycharts

Distributions Allow Attractive Payouts From Tech

Historically, tech isn’t an area that pays out really high dividends to investors. In the case of BST and BSTZ, the results of the CEF structure allow for monthly distributions from these funds. The distributions can come in the form of income, gains and return of capital. For these funds, neither has a positive net investment income figure, meaning they will rely entirely on capital gains or return of capital.

Both BST and BSTZ had their entire distributions classified as long-term capital gains in 2021. Official tax data for this year won’t be known until year-end. Due to the trajectory of the market and challenges, we wouldn’t be too surprised if we see return of capital in their distributions.

While capital gains can become harder to come by in this tech sell-off that is continuing to grind these funds lower and lower, all hope isn’t lost. They have built-in capital gains that they can continue to utilize. At the end of 2021, BSTZ had over $1.5 billion in unrealized gains, and BST had nearly $886 million. These figures would have come down at this point, with losses in the underlying portfolios continuing.

Despite almost everything tech-related being sold off, they can still produce gains by buying low and selling high. Often, this isn’t the case with CEFs, as that would require very active management.

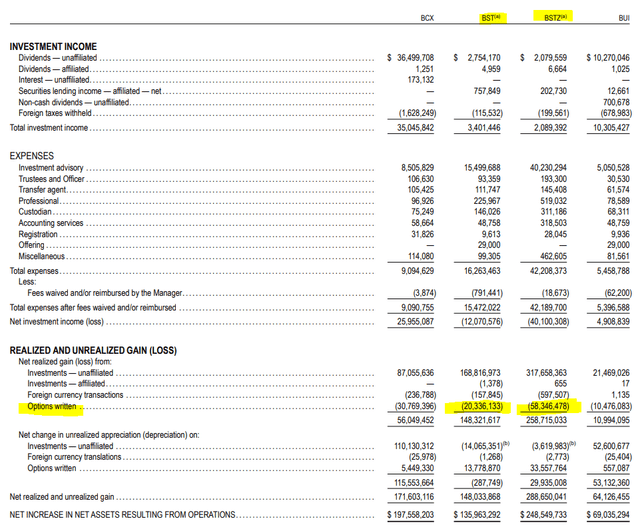

Additionally, this is where the options strategy can come in handy too. Traditionally, the covered call writing on individual names in the portfolio had resulted in losses for the funds. We can see this for both funds in 2021. It wasn’t massive losses relative to the size of these funds, but losses nonetheless.

Annual Report (BlackRock (highlights from author))

This can happen when they buy a position back to close it before being called away. However, with the losses accumulating this year, they shouldn’t be buying positions back to get out of the contracts. This should provide realized capital gains for the funds this year. That can offset some of the declines experienced in the funds.

Since capital gains will be harder to come by, I believe both funds are at risk of distribution cuts if things don’t improve. BSTZ is more susceptible as the fund’s NAV distribution rate pushes higher at 9.59%. For BST, they are at an 8.38% distribution rate on the NAV. Either way, these funds will remain an attractive place to look for “income” from tech holdings where tech would otherwise normally pay relatively smaller yields.

A Look At The Portfolios

BST

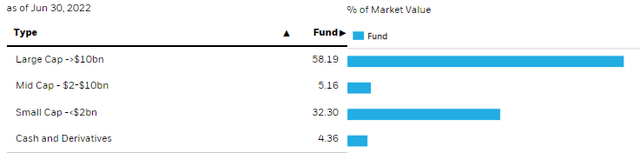

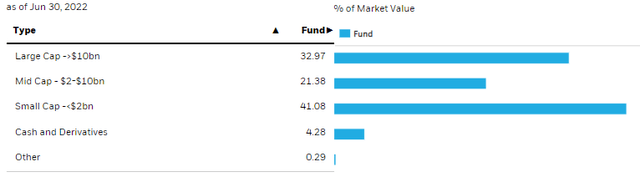

As mentioned previously, BST was traditionally holding onto larger cap names. They still are but have been shifting more towards small-cap names. Here’s the latest that shows they have once again shifted a bit more to small-cap names. The average market cap of their holdings is $581,353.9 million.

Perhaps, some of this even being the result of mid-cap or large-cap names falling all the way to small-cap status. It isn’t too wild to think, considering some of the tech names have seen drops of 70% or more in their share price.

BST Market Cap Weighting (BlackRock)

The small-cap exposure had really picked up over the last year. Looking at the weighting of last June 2021, small-cap was only around 17% of the portfolio. It was also an increase from even before that when no project names showed up in 2020. This shift will either turn out to be genius in the long run or poorly timed. The verdict is still out.

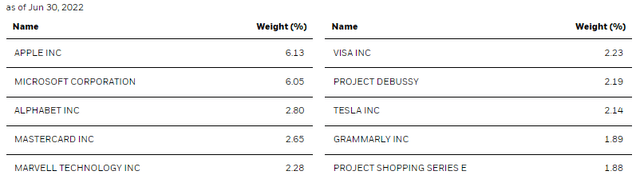

Looking at the top ten, they still hang onto names such as Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOG). However, we have a couple of the “project” names in the top ten. Those are associated with private investments that are found more commonly in BSTZ.

BST Top Ten (BlackRock)

BSTZ

When looking at BSTZ, we still see a higher relative weighting to small-caps, and mid-caps also make up a meaningful allocation. Large-cap weightings were nearly 52% of the fund previously. A sharp drop in tech presumably provided some of the declining weightings here too. The average market cap weighting for BSTZ comes to $53,454.1 million.

That’s a substantial difference from BST. It goes back to AAPL, MSFT and GOOG, though, where those names disproportionately raise the average market cap of the underlying holdings. They are between $1.5 and $2.5 trillion market cap companies.

BSTZ Market Cap Weighting (BlackRock)

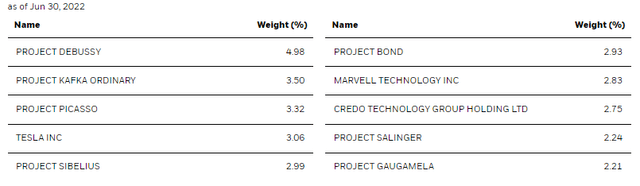

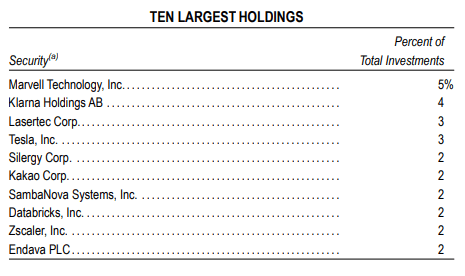

In terms of the top ten of BSTZ, we see some new project names. Again, these are their private investment codenames. Project Bond, Project Salinger and Project Gaugamela are new appearances on this list from our previous BST/BSTZ piece. We now have seven project names on the list from the previous four at the beginning of the year. This was six just earlier this year, too, in my most recent update on BSTZ. Project Gaugamela is the latest addition. They do not have their second-quarter commentary available at this time.

BSTZ Top Ten Holdings (BlackRock)

Earlier in July, Klarna (Project Kafka) had its valuation drop again when they raised a new round of cash. That would suggest that we will see BSTZ reprice that position lower when they update.

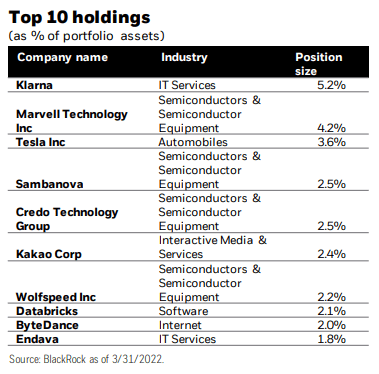

BSTZ Top Ten 03/31/2022 (BlackRock)

“Project” Obfuscation

If you want a clear, concise portfolio where you know what you are holding. BSTZ probably isn’t it. I’ve done my best to try and nail down what some of these project names are referring to. Klarna is an easy one, but they seem to make it difficult.

One way I thought it would be easy to compare is when they list the holdings on their site and then refer to their year-end annual report.

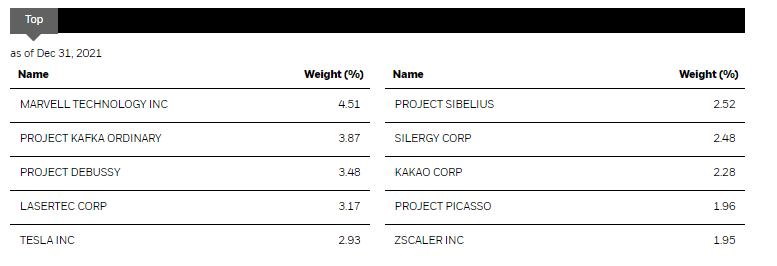

Here we see a snapshot of the December 2021 holdings for BSTZ.

BSTZ Top Ten 12/31/2021 (BlackRock)

Go to the year-end report, which is also the same December 31st, 2021, reporting date, and this is what we get.

BSTZ Top Ten 12/31/2021 (BlackRock)

We see here that the top ten holdings on their website aren’t exactly making sense because they are top ten “exposure,” not specific holdings.

See Project Debussy? That’s Databricks. How can that be? This is because they hold three different positions in Databricks that combined are $106,513,808 in value at the end of 2021. Against the total net assets at that time, it works out to around 3.5% or close enough to the 3.48% they have listed.

Yet, the annual report shows that Databricks is listed as the eighth largest weighting. That’s because they have one position – the Series F round at $62,212,977 – working out to 2.04% or the 2% they list.

Conclusion

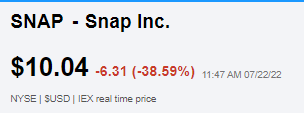

BST and BSTZ continue getting slammed into the tech sell-off that doesn’t seem to be letting up. With Snap (SNAP) reporting poor results and crashing 38.6% at the time of this writing, it doesn’t seem that tech is ready to rebound yet.

SNAP Price 7/22 (Seeking Alpha)

These will be longer-term positions in my portfolio. If I were putting capital to work today, I’d lean more towards BSTZ with the larger discount. However, with the heavier private investments, the discount here could be more appropriate. Private investments can be restricted, and the valuation unknown until they go to sell. One would have to be okay with this higher risk proposition before investing in BSTZ.

BST continues its trend towards investing in smaller companies, leaning into BSTZ’s space. This will either result in them looking like geniuses in the long run, or I’ll just have two poor-performing funds in the end.

[ad_2]

Source link