Rate hikes won’t lead to stress: Axis CEO

[ad_1]

How did Covid change the way you do business?

We took the opportunity to bridge the gap on the technology side and went on from being slightly behind the curve to be a frontrunner. While our share of deposits and advances is 5-6%, we have a 15-16% share in digital banking and a 30% share in Bharat Bill Payment System. On the merchant-acquisition side our incremental share is 31%, and we have a 30% share of incremental credit cards. We have built a data stack and have data on about 42 crore customers. We are moving on universal underwriting, where we can make an offer to any customer who approaches us. We launched new ways of working, and 3,600 employees are under the ‘work anywhere’ model and 12,000 are in the hybrid model. Our employees are generally happy with this, and we are getting positive feedback.

Has the new working model helped to bring down attrition?

While our attrition is in line with the industry, if you look at our satisfaction scores they are moving in the right direction. The attrition for the sector has gone up and, obviously, the frontline (branch staff) attrition tends to be much more than for the bank as a whole. The attrition is not only in financial services but all across. It is bothering us, and there is an internal project to see what can be done to control attrition and it is being monitored at the board level.

The RBI has described the Ukraine war and subsequent inflation as a second Black Swan event. Do you see any impact on asset quality?

Globally, there is uncertainty over the future path of inflation and markets are pricing in further tightening by the central bank for the rest of the calendar year. The RBI has already done 140 basis points (100bps = 1 percentage point) of interest rate increase. If you were to look at the worst-case scenario, it may be another 100bps at the most. It is all about economic growth, and policies for private entrepreneurs to invest rather than interest rates coming in the way. Banks have been cleaning up their books for a long time and have a pristine retail book where customers have gone through two washes of Covid. This shock, in comparison, if it was not for a sustained period, is nowhere close.

Given the monetary policy tightening, what is your credit and deposit strategy?

We are not growing fast on the high-end corporates as we believe the interest rates there give us margins which do not make sense on return-on-capital perspective. Our mid-corporate, SME and multinational corporation business side is growing at a good rate. On deposits, we are working on the granularity and premiumisation. By granularity, what I mean is we are focusing on gaining market share at each district level by growing branch network and coming out with solutions for each segment of customers. We are coming out with a new value proposition on salary accounts. The Citibank acquisition will continue to push optimisation of the deposit franchise.

Did the pandemic delay the timelines under your GPS strategy? When will the bank see results?

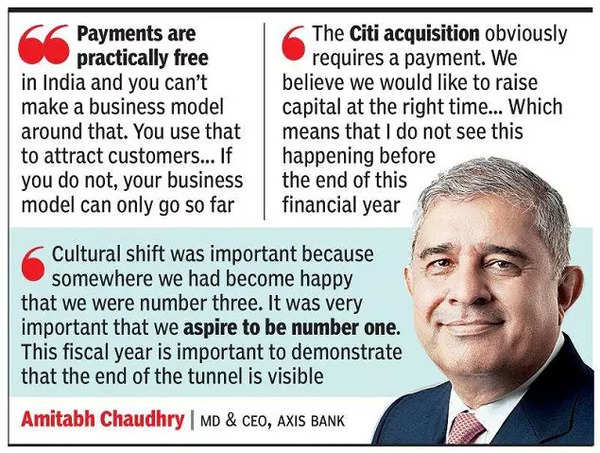

We had a three-year strategy. Covid did push us back a little bit. Some of the problems turned out to be slightly deeper than I thought. Three things we focused on — cleaning the overhang of the past, cultural shift and building for the future. Cultural shift was important because somewhere we had become happy with the fact that we were number three. It was very important that we aspire to be number one. I am very happy that in many areas we are becoming number two and number one and our position is improving. We were the first to come out with a board committee on ESG (environmental, social & corporate governance), we are embedding climate risk dimensions in our risk frameworks, and we are working with a multilateral institution to do that. This financial year is important one to demonstrate that the end of the tunnel is visible. If you look at our numbers for the fourth quarter and take out exceptional items, we have exceeded 18% ROE (return on equity).

You have invested a lot in payments. What is the plan?

The overall value proposition for the bank in each of these is that you may initially or upfront end up spending money. But over a period of time, if you can convert them into deep customers of Axis Bank, they are quite profitable. That is one of the reasons why our operating expenses have gone up. Our acquisition engines have picked up pace and there is some upfront cost, which is getting reflected in our profit and loss. Payments are practically free in India and you cannot make a business model around that. You use that to attract customers and then, hopefully, you can attract customers for opening deposits or taking loans. If you do not, your business model can only go so far.

Citibank customers are uncertain about what’s in store…

The most important thing we have to do is to make the experience for the customer so seamless that they do not realise the change. We will ensure that whatever services, features, benefits that Citi is providing, they will be matched or they will get more. For example, on day one, Citi customers will get a half percentage more on their savings deposits. The consent seeking is not just one-time, we will seek it in a simple way. Then, if required, we will call them or meet them. As part of the integration process, product mapping is being done so that every card and every service is available.

Your comments on the front running charges on Axis MF executives…

We launched a suo motu investigation on our own following some chatter in the market. So, the investigations were going on when it started blowing up in the Twitter world. We have taken action against the two employees. Most of the news is around one employee and obviously they have violated securities law, which is why they were terminated. We have, as an institution, used top notch agencies to check all the trades for a defined period. We want to ensure that we use this opportunity to learn and tighten our controls even further.

Will you be raising capital?

We raise capital every couple of years. The Citi acquisition will obviously require us to do a payment. We are not boxed in, in terms of what we must do, to raise capital. We believe that we would like to raise capital at the right time to be fair to our existing shareholders. Which means that I do not see this happening before the end of this financial year at a minimum.

[ad_2]

Source link