The alternative asset class needs new infrastructure — who will build it? • TechCrunch

[ad_1]

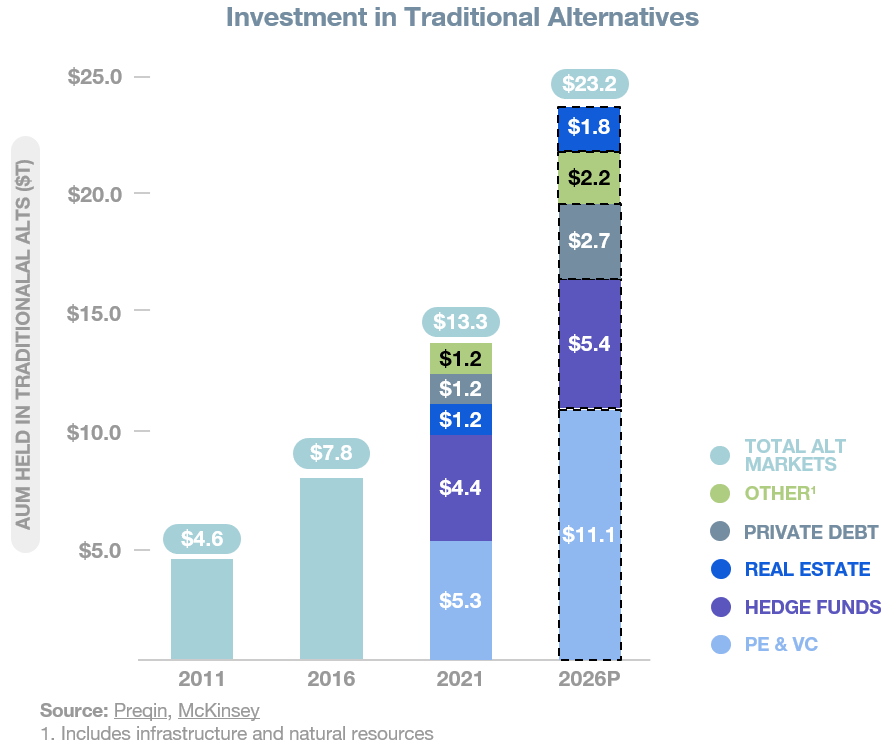

It took more than 30 years for alternative asset classes like venture capital, private equity and hedge funds to become must-have portfolio allocations, but they have finally arrived in force. Private investments in alternative assets grew to $13.3 trillion from $4.6 trillion over the 10 years ended 2021, and advisers now routinely recommend allocating 10%-25% of portfolios in these asset classes.

Liquid alternative asset classes are enjoying record inflows, and B2C-friendly distribution platforms like Moonfare, Fundrise and SeedInvest are building on-ramps for a new generation of investors.

Just as these traditional alternatives are becoming a consistent part of the modern investment portfolio, a new era of alternative assets is emerging, fueling an even broader and more fragmented landscape for investing. Dozens of platforms have launched to fractionalize, package and distribute everything from farmland, litigation finance and P2P lending to art, wine and collectibles.

Crypto added fuel to this trend and quickly became a mass-market asset category. Together with more established alternative classes like venture capital and private equity, these new alternatives give retail investors unprecedented access to asset classes that either never existed (like crypto) or were previously limited to high-net-worth investors.

However, there is a problem in alternative assets: the lack of digital infrastructure. Traditional alternative assets like venture capital and private equity at least have an ecosystem built to serve them, but that infrastructure is aging and built for a narrower base of institutional investors, like endowments, pension funds and large family offices.

As these asset classes scale and diversify their investor bases, they need a serious upgrade to modernize the fund manager/GP and investor/LP experience. The situation for emerging alternative assets is far worse. Today, investment platforms cobble together their operations — sourcing, brokerage, reporting and custody — while investors endure fragmentation throughout their journey of discovery, account creation, execution and reporting.

For these asset classes to scale, they will need institutional capital, actively managed funds and financial advisers — and all of these depend on better data.

Let’s start with traditional alternatives

Yes, it’s oxymoronic to call alternatives “traditional,” but after more than 70 years, over $13 trillion in AUM and 10%-25% portfolio allocations, it’s hard to say that venture capital, private equity, private credit and real estate are novel forms of investment.

Investment performance for “traditional alts” is even highly correlated with public equities. The most enduring distinction is the accredited investor requirement (just 10% of the U.S. population), but Reg CF, Reg A+ and a myriad of platforms like SeedInvest and WeFunder are prying open that door as well.

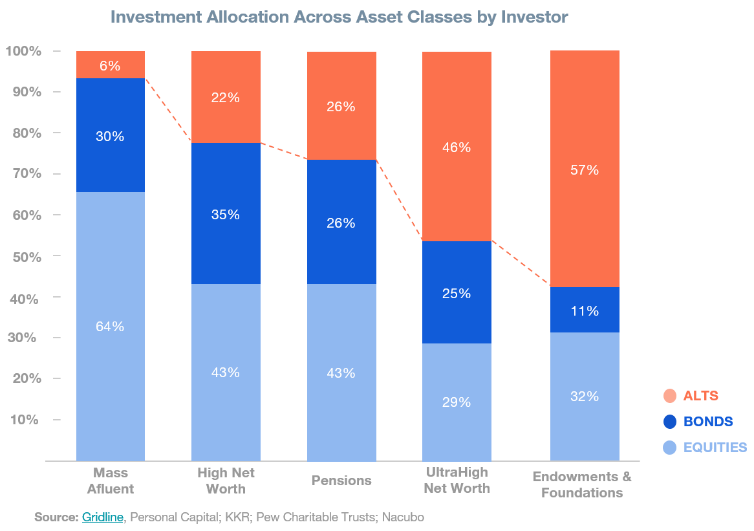

Image Credits: F-Prime Capital

As these asset classes scale, fund managers are systematically diversifying their investor bases beyond institutional investors like pension funds and endowments. The old and labor-intensive processes built around 30-year tech stacks from FIS Investran, State Street and Citco will not scale to 100,000+ financial advisers and millions of accredited investors. What’s more, the user experience is so bad, you would not want to scale it: PDFs, manual bank wires and clunky investor portals are the current “state of the art” here.

Image Credits: F-Prime Capital

Modernizing the infrastructure for traditional alts

Fortunately, entrepreneurs are tackling the problem posed by antiquated infrastructure for traditional alternative investments.

[ad_2]

Source link