In Search of Corporate Travel’s Elusive Recovery

[ad_1]

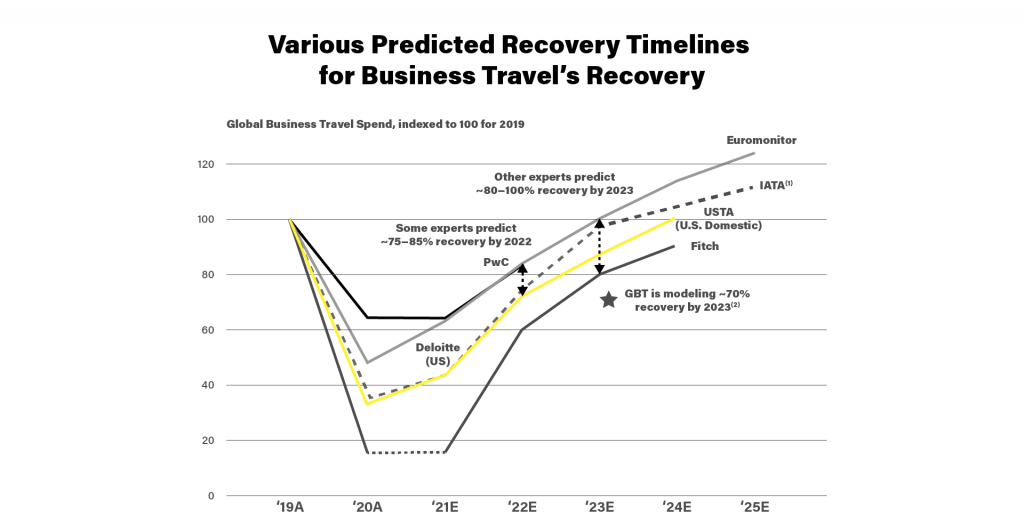

The one narrative for the post-pandemic travel rebound that has largely remains in dispute now some two and a half years later, fueling prognostications from all sides, is the recovery of business travel.

Just as a flurry of new late summer forecasts for a full business recovery hit — again with no real consensus — a story was gaining a lot of attention that Google, once the giant of sending people out on the road in a Google-outsized kind of a way, was cutting back its travel budgets for what it called only “business critical” trips.

It was just another piece of evidence for business travel doubters that the industry will never be restored to its glory days. That’s because after a challenging couple of years (and counting in some countries) the business travel industry has been looking back, misty-eyed, to the better times of 2019, asking: When will it be like that again?

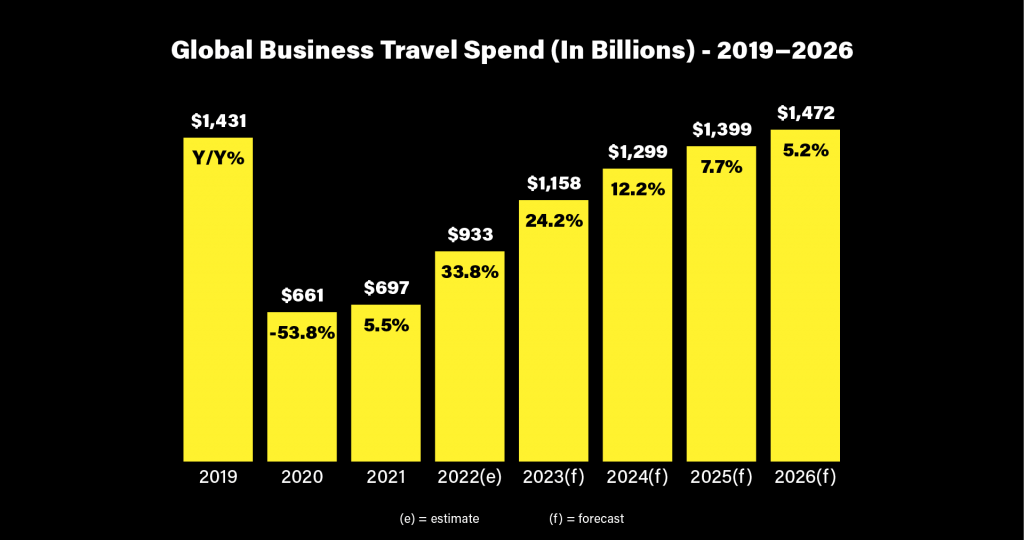

More specifically it’s been looking back at the $1.4 trillion that was spent on business travel, based on the Global Business Travel Association’s calculations.

We all know business travel is a high-margin game. Hotels, airlines and travel agencies have suffered following the prolonged absence of higher-paying corporate guests. The trickle-down effect of those company dollars and generous expense allowances to local restaurants, conference venues, taxi firms and others in the wider ecosystem also dried up.

What About That $1.4 Trillion Question

The $1.4 trillion figure has appeared extensively in the media, financial reports and investor pitch decks for several years.

But the magic number’s been more prominent recently as observers look to the end of summer as a kind of coronavirus cut-off point, with new forecasts attempting to pinpoint exactly when this “recovery” will take place.

Earlier this year, many people were looking to the fall as a true test for corporate travel’s resiliency as some doomsayers have said it will never return to its former vibrancy.

“Autumn is conference season — a time that has grown in importance following the pandemic, as an increasingly distributed workforce looks to make the most out of travel by meeting with colleagues, industry peers, and clients to advance business goals,” said TripActions in its Fall Business Travel Preview.

The Global Business Travel Association predicts the $1.4 trillion in spend will now return in 2026; there’s some way to go still considering the (relatively) low base of $661 billion spent on business travel in 2020, when Covid-19 was at its global peak.

This is how it thinks it will play out: an estimated $993 billion will be spent in 2022; $1.2 trillion is forecast for 2023; $1.3 trillion in 2024; $1.4 trillion in 2025; and $1.5 trillion in 2026.

Is Forecasting Even Relevant?

With so much global uncertainty impacting the business of travel, including inflation, the war in Ukraine, hybrid working and plenty others, are forecasts still relevant?

Yes and no is the answer.

There’s still a need for that baseline, but at the same time so much has changed, and continues to change, in the world of work, which by its nature impacts corporate travel.

“Somebody has to forecast, I’m glad they’re doing it,” Katharina Navarro, a travel manager at a large consultancy and president of the Global Business Travel Association in France, told Skift.

In fact the return of business travel demand has long been among the most difficult sectors for CEOs to predict.

“Honestly, if I go out to ask consultants for data points over the next three years, everybody’s being very hesitant. Nobody wants to say. But a forecast is a forecast. If it changes, I adapt, I correct my assumptions. I feel too many people now aren’t saying anything, and that’s not helpful.”

From a bird’s-eye view perspective, forecasts are there to help suppliers gauge future demand and markets, and travel management companies to manage resources. So yes it does matter, for example, that Latin America is forecast to grow 55 percent this year.

And many in the industry do look to the association’s annual outlooks, which it carries out with Rockport Analytics.

“Our view of the contribution to each country-sector combination has been established by analyzing trends in the business travel purchasing behavior of 44 sectors across 73 countries over a period of more than 20 years. By modeling trends of the level of business travel spending per dollar of industry sales (a measure of business travel productivity) over time, we are able to extend these factors into the future,” it says.

No one else is able to be as thorough, or distinguish between business and leisure activity, the association claims.

“By and large, it’s volume that’s the tide that we ride in this space,” said Nick Vournakis, executive vice president and chief customer officer at CWT. “That’s how the supply chain evaluates other businesses, and that’s how they think.”

Where Are We Now?

As leisure travel traffic slows after summer vacations, and schools and offices reopen, all eyes are watching the data for business trips as a sign of things to come. A natural bounce is expected because that pent-up demand is still very much there.

The positive trends for the first three quarters of 2022 provide a good base for a clearer picture 2023, according to Guy Snelgar, global business travel director of the Advantage Travel Partnership.

“We are seeing wide variations in corporate travel forecasts this autumn and winter,” noted Scott Davies, CEO of the UK’s Institute of Travel Management. “While some organizations are trying to limit travel to well below 2019 levels due to economic uncertainty and rising costs, many companies are playing catch-up by traveling extensively to support both internal and customer engagement.”

TripActions identified a “similar seasonal surge” in business travel, despite concerns about the macroeconomic environment. The startup corporate travel agency has seen a sixfold year-over-year increase in business travel bookings with a start date between September 1 and November 19, 2022, compared to an equivalent booking window and trip start date last year.

After Labor Day in the U.S. it said it had broken its largest booking and travel spend record, with a 28 percent increase week-over-week.

“There’s been a lot of consternation around this idea of September as a line of demarcation, because it’s the end of the summer holidays in the West. We see a tremendous amount of seasonality where there’s generally a natural dip in business travel in July and August, and a rebound from September to November,” added CWT’s Vournakis.

“We don’t expect this calendar year to behave any differently than that, but the idea that there’s going to be a mass exodus starting September 1, as it relates to business travel, I’m not sure we’ll see that come to fruition.”

Instead he predicts a healthy resurgence with a growth curve that will be slow but consistent: “We’re on a recovery trend, it won’t get steeper.”

The Difficult Task of Forecasting

Not everyone thinks the same. “Much of the annual 2022 travel budget expenditure has already concentrated in the first and second quarters of 2022, leaving challenging third and fourth budgets for the full year of anticipated spend,” warned Paul Tilstone, managing partner of consultancy Festive Road.

However, if the only way is up, now is probably the best time to reflect on how business travel is measured. The challenge will be predicting which types of companies will travel, how they do it and crucially why in the age of the Great Merging, where work, travel and life in general.

The future of work trends and the nascent generation of digital nomads — long-term travelers that live and work anywhere, and have the potential to be a small and mighty traveler type — is a vast-ranging topic itself.

But gathering new information, even up-to-the-minute trends, could help the travel industry adjust, react and recover perhaps more than charting patterns from the bigger companies.

A more urgent topic is exploring the sizes of companies now traveling, for newer purposes. Before the pandemic they were under the radar, but if larger companies do cut back on travel in the long term, for sustainability reasons or otherwise, they’re going to become a force to be reckoned with. (At an extreme micro level, what kind of significance does next generation hospitality company Selina’s partnership with freelancer network Fiverr have?)

“The bottom line is, we saw a quicker return to travel from the small and medium size market in the early parts of this year, but we’re seeing equal amounts of recovery in terms of slope and rate in the enterprise space now,” said CWT’s Vournakis. “In fact, some of our largest clients are outstripping the travel they did in 2019.”

Small firms probably benefited from having fewer corporate regulations and restraints. But as inflation and energy prices creep up, there’ll likely be a swing of the pendulum this year. “There’s more wariness around managing the inflationary pressures that come along with this resurgence in travel demand. You’ll see more sensitivity to that in the lower end of the market, compared to the higher end,” Vournakis added.

But size matters, and corporate card and expense management Ramp, which has raised $1.4 billion since it was founded in 2019 and is seeing huge growth in travel, is calling for change.

“Everyone in the business travel industry has been talking about managed travel for small and medium-sized enterprises forever. It’s never worked,” Ben Alderman, head of financial, travel and accounting partnerships, told Skift.

“No one has had any success, because it just doesn’t matter enough to (travel agencies) if they’re spending $50,000 or $100,000 a year on travel for them to manage that.”

Ramp’s expense platform allows companies to set policies, and Alderman said spend was a lagging indicator, but policy was a leading indicator. It June this year its clients had made an average 25 percent reduction in allocated employee travel budgets for the future, which could indicate more people were traveling, and that the employer simply wanted to rein things in; travel, as a proportion of card spend, is increasing at a double digit percentage.

There’s now value in tracking more of these on-the-fly trends. “The data coming out of large corporates is herd behavior,” Alderman said. “They all tend to do the same things, so you have similar feedback and metrics out of the large travel management companies. It’s very rare American Express Global Business Travel turns around and says something completely different to CWT. That just doesn’t happen.”

He said it’s worth tracking small and medium-sized enterprise behavior because they’re such a huge part of the economy.

“Traditional travel policies have been thrown out the window since Covid,” he added, because of erratic travel costs. “In the micro SME space, people just needed to get back out there again, and the policy they had sat in the draw from two years ago didn’t make sense any more.”

Units, Not Volumes

It’s also time to enhance the methodology.

One experienced travel manager, working for a large business consultancy specializing in the pharmaceutical sector, said that looking back to 2019 fails to recognize that businesses are in different shapes and sizes today. In some cases, a missing three years of growth should be factored in. The pandemic throttled most businesses, but many sectors thrived in those dark years, notably pharmaceutical and software companies.

“We quadrupled in size over the pandemic,” he said, preferring to remain anonymous. “Where most people might look at their return to travel levels and monitor it via business trips, I didn’t want to do that and just come up with a number. We’ve obviously seen a (travel) growth rate due to the fact that our company is a lot bigger than it used to be in terms of headcount.”

While travel spend had increased, he removed the growth element and calculated the proportion of employees who traveled in the first two quarters of 2019, versus those same quarters in 2022. Rather than how much they traveled, how many people traveled?

The result was that his company’s true “return to travel” figure was at 45.5 percent of 2019, meaning half as many employees were traveling for business.

A New Era of Accountability

Further ahead, travel managers are predicting the way they carry out their jobs change to reflect this change in work.

Justifying the purpose of travel in a little more details is becoming common, with Google one of the latest mega-companies to clamp down and ensure travel more “critical” than social.

With rising prices, there’s a renewed on data and a focus on explaining the reasons for any increases.

“As we’re coming to the end of the year, we’re having negotiations with our suppliers right now,” Navarro said. “We’re trying to understand the impact of inflation on the different categories. There’s a common understanding from finance that prices are going up, but the impact of procurement is to mitigate as much as we can to see how much of our program we can consolidate.”

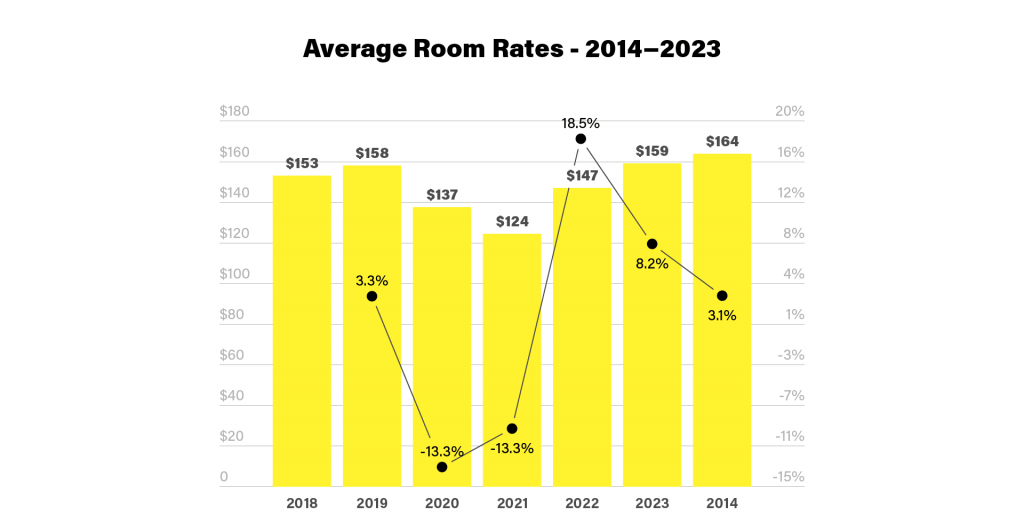

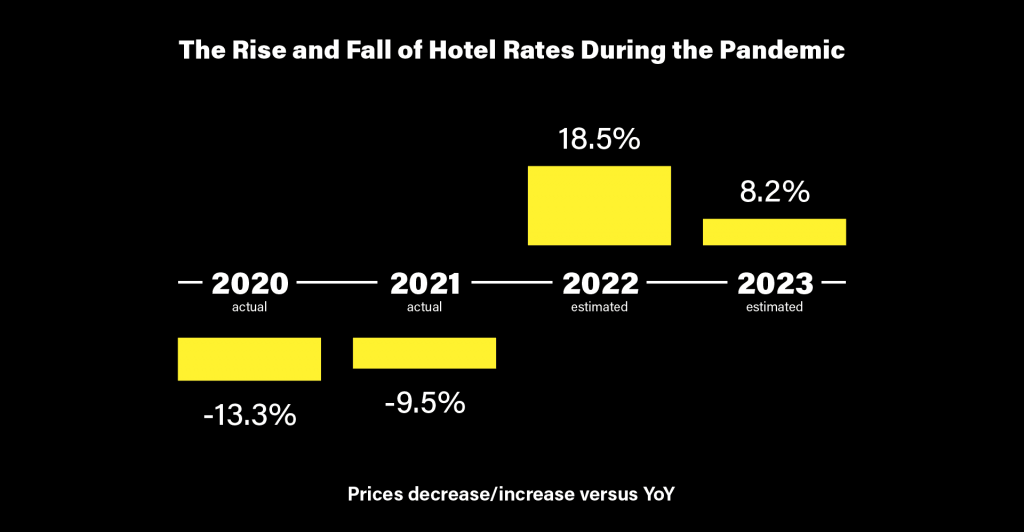

She wants to better understand the breakdown. For air, how much is the fuel component, how much is labor contributing, for example. “For airlines, I can see more centralized data. It’s comparable between airlines, but for hotels it’s very different, depending on the ownership structure, brand or location. I can see hesitation and pushback. You have to be careful, some suppliers have tried to offload increases over the past couple of years. I’m confident of the prices I have right now, but I don’t want to lose my competitive edge.”

A recent USA Today article predicted hotel fees were now starting to change, with the next big charge set to be daily housekeeping fees. The previous uproar was over resort fees, which are also set to make a comeback.

With accountability comes the accountants. Skift argued that “corporate travel is now in the firm grip of the CFOs,” but one travel manager, working for a U.S. based TV production company, said it’s not so controlled. With travel programs not quite recovered, he’s seeing eye to eye a lot more due to the ongoing hesitancy to travel.

“For employees, there is an awareness they don’t need to travel,” he said. “We kind of agree this is the right level of spend. Travelers on the whole are more cautious and the disruption still continues. Trips for internal meetings are just not happening, and execs are meeting quarterly or yearly.”

Don’t Call It a Recovery

This natural correction seems to be here for the long term. Another travel manager, based in Europe and working for a recruitment firm, said his company’s leadership were coordinating in advance and combining meetings.

“I don’t have the confidence business travel is going to see the pick-up maybe that the industry is hoping for,” he said. “It’s going to be a slow burn, it’s not like it’s a quick snapback to reality after a few months, which is what we thought in the beginning.”

Further ahead, Navarro believes that in the future travel managers will be working with two currencies: the price of the ticket, and the carbon impact of the ticket. Microsoft already charges itself an internal penalty based on the carbon emissions that its travel generates. With increased scrutiny, more corporates may find their travel will need to shrink faster than expected.

“We won’t see it necessarily in 2023, but the idea that there might be carbon budgets to go along with spend budgets for travel is not that far off,” agreed CWT’s Vournakis. “It’s very conceivable that the more progressive corporates who lean into this will have clear carbon budgets starting in 2024.”

Tilstone’s snapshot, like many others, is that the remainder of 2022 won’t set the demand agenda for the future, with 2023 also set to remain in flux, as companies that moved to remote ascertain what value face-to-face brings, and when travel adds value.

“I struggle with the word recovery. Recovery means we’re going back to where we were before. We’re not. We’re going into a new way of traveling, and managing travel, with more focus on sustainability,” Navarro said. “It’s not a recovery, it’s a redesign of the industry.”

Her sentiments echo those of workforce strategist Mattison, who told delegates at Global Business Travel Association convention: “I talk to a lot of leaders. There is sometimes subtle, and sometimes not so subtle, ethos or mindset of: ‘We got through it (Covid), and now we can get back to normal,’” said workforce strategist Seth Mattison at the Global Business Travel Association convention in San Diego in August.

“I hate to be the bearer of bad news, but there is nothing to go back to. That world is gone. Why? Because we have changed as people, and we have changed as a society. We changed the way we work and the way we create value for our customers.”

His said travel managers now played such an important role in shaping the experiences of their colleagues.

“And guess what, the future of work is changing the future of business travel. We have a chance to rethink, design and reimagine what this can look like,” he said.

[ad_2]

Source link