Robert Kiyosaki Wealth Mentor Confronts $1.2 Billion Debt: Empowering Strategies for a Resilient Comeback

Robert Kiyosaki Embraces $1.2 Billion Debt as Strategic Leverage for Wealth Creation

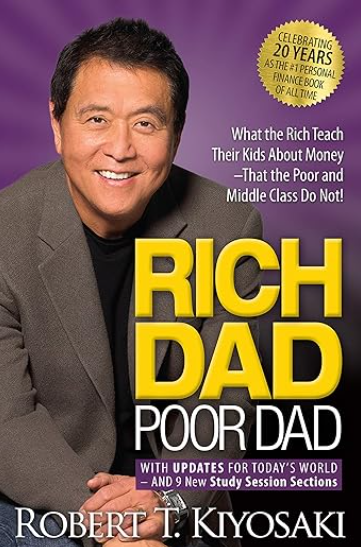

Renowned for his ‘Rich Dad, Poor Dad‘ series, business luminary Robert Kiyosaki recently disclosed his $1.2 billion debt, emphasizing a unique approach to financial strategy. In an insightful Instagram Reel, Kiyosaki outlined his philosophy on debt, showcasing how he utilizes it to acquire income-generating assets, unlike conventional practices.

The 76-year-old, also an astute investor, attributed his substantial debt to his unconventional approach of saving in gold and silver since the detachment of the US dollar from the gold standard in 1971. Notably, Robert Kiyosaki considers luxury vehicles as liabilities and elucidated that he pays off such acquisitions in full, considering them as such.

Highlighting the concept of ‘good’ debt, Robert Kiyosaki advocated loans used to acquire assets that generate income, such as real estate, businesses, and investments. Furthermore, he endorsed investments in ‘real assets’ like Bitcoin, gold, silver, and Wagyu cattle, singling out Bitcoin as a crucial hedge against the diminishing value of the US dollar.

In his candid revelation, Kiyosaki underscored his belief in leveraging debt as a strategic tool for wealth creation. He emphasized that while many individuals accumulate debt to finance liabilities, he strategically employs it to acquire assets that contribute to long-term financial growth.

Robert Kiyosaki unique perspective on luxury vehicles as liabilities sparked further discussion. By deeming his Ferrari and Rolls Royce as liabilities, he sheds light on his disciplined financial approach, ensuring that even items associated with indulgence are acquired with financial prudence.

The financial maverick elaborated on the distinction between ‘good’ and ‘bad’ debt. According to him, debt becomes ‘good’ when used to acquire assets capable of generating income, such as real estate, businesses, and strategic investments. This strategic use of debt aligns with Kiyosaki’s overarching philosophy of making money work for him rather than being burdened by it.

Expanding on his investment recommendations, Kiyosaki advocated for ‘real assets’ as key components of a diversified portfolio. Bitcoin, gold, silver, and even unconventional choices like Wagyu cattle were touted as valuable investments. His particular affinity for Bitcoin stems from its perceived role as a reliable hedge against the diminishing value of the US dollar, underlining his commitment to staying ahead of financial trends.

In conclusion, Robert Kiyosaki’s open discussion on his substantial debt unveils not only a financial reality but also a strategic mindset that challenges conventional norms. His commitment to turning debt into a powerful tool for wealth generation and his unorthodox views on asset categorization continue to make him a thought leader in the realm of personal finance and investment.

Furthermore, Kiyosaki delved into the origins of his considerable debt, tracing it back to a pivotal moment in economic history. He pointed out that his decision to accumulate debt was influenced by the detachment of the US dollar from the gold standard in 1971 during President Richard Nixon’s administration. This historical shift prompted Kiyosaki to adopt a unique approach, focusing on saving in gold and silver to safeguard his wealth against potential currency devaluation.

The astute businessman’s philosophy extends to his daily choices, including the luxury vehicles he drives. By branding his Ferrari and Rolls Royce as liabilities, he challenges the traditional notion of these high-end possessions as symbols of success. Kiyosaki’s approach serves as a testament to his financial acumen, reinforcing the idea that even extravagant purchases can be managed strategically.

In his discourse, Kiyosaki made a clear distinction between ‘good’ and ‘bad’ debt, advocating for the former as a means to acquire income-generating assets. Real estate, businesses, and strategic investments fall into the ‘good’ debt category, aligning with his overarching goal of building a portfolio that generates sustainable income over time.

Expanding his investment advice, Kiyosaki endorsed ‘real assets’ such as Bitcoin, gold, silver, and even the unconventional inclusion of Wagyu cattle. His strong endorsement of Bitcoin, in particular, stems from its perceived role as a hedge against the eroding value of the US dollar, showcasing his forward-thinking approach to financial security.

Robert Kiyosaki’s narrative not only highlights his current financial situation but also serves as a masterclass in financial philosophy. His willingness to share insights, challenge conventional norms, and advocate for strategic debt usage positions him as a thought leader, inspiring others to rethink their approach to wealth accumulation and financial resilience.

For the latest updates-click here.