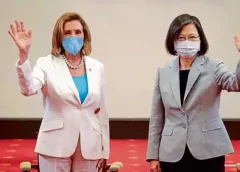

Pelosi’s Taiwan visit presents an opportunity for India

[ad_1]

What followed Pelosi’s visit to Taiwan?

China said it conducted “precision missile strikes” in the Taiwan Strait as part of the biggest military action in decades in the region. Beijing regards the self-ruled island as its territory. Live-fire military drills were carried out in six zones, which Taiwan has called a violation of UN rules, an invasion of Taiwan’s territorial space, and a direct challenge to free air and sea navigation. Ahead of Pelosi’s visit, China banned shipments from more than 100 food exporters from Taipei in an attempt to add economic pressure. China’s commerce ministry had said on Wednesday that it would suspend exports of natural sand to Taiwan.

What sectors could be affected?

Electronics and automobile sectors, which have barely emerged from a chip shortage, could be in trouble. Taiwan Semiconductor Manufacturing Co.makes about half of all chips in the world. About 60% of smartphones use its chips. Taiwan’s United Microelectronics Corp. makes chips used in cameras, printers, vehicles, and smart appliances. India is dependent on chip imports for its indigenous industry, and its ₹76,000 crore production-linked incentive scheme for chips will take time to take off. Meanwhile, the US has passed the Chips and Science Act to become self-reliant in chips.

You might also like

Does RBI policy need the attention it gets?

Shadow bank Indostar flunks viability test

How is tax calculated on sale of apartment?

India’s oldest wealth portal grew 7 times in 2 years

What could be the visit’s economic consequences?

Escalation of US-China tensions may cause another shock even as the world grapples with the Russia-Ukraine war and recovers from a pandemic. It may impact supply chain and demand, keep inflation high, and cause tighter monetary policy. That may impact investments and further flight of capital from developing countries, eroding local currencies.

What was the impact on India?

The rupee weakened sharply against the US dollar on Wednesday and Thursday, amid concerns over the impact of worsening ties between the US and China. Investors were seeing movement towards the safety of the US dollar. The rupee recovered marginally to 79.23 against the US dollar on Friday after it weakened to 79.5 against the greenback on Thursday. The rupee has weakened 6% against the US dollar so far in 2022. A weaker rupee adversely impacts India’s import bill, and widens the current account deficit.

Will this present an opportunity for India?

India has so far maintained silence over the matter. However, US-China tensions may present an opportunity for India to make its way into the global supply chain, displacing Beijing. Countries, including Australia, are already attempting to shift supply chains away from China and are forging ties with New Delhi. India, Japan and Australia had last year put together a Supply Chain Resilience Initiative (SCRI). More such ties are expected to come up with India at the centre.

Elsewhere in Mint

In Opinion, Manu Joseph replies to free-speech warriors. Mythili Bhusnurmath says MPC is out on a wing and a prayer. Long Story has a cheeky take on the jargon of stock market.

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint.

Download The Mint News App to get Daily Market Updates.

More

Less

[ad_2]

Source link