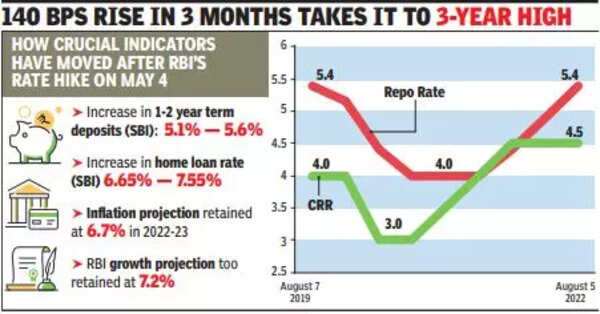

Second 50bps hike: Repo rate’s now over pre-pandemic level

[ad_1]

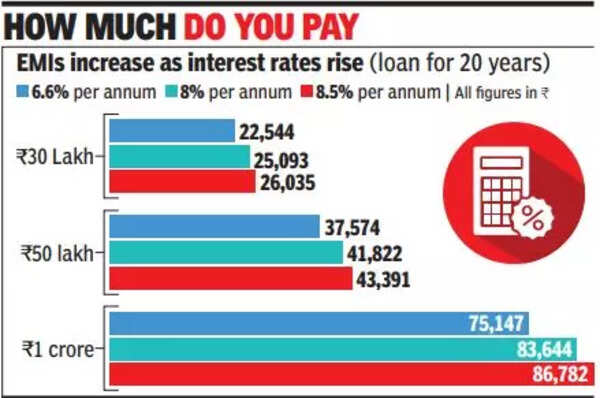

It’s the third hike in quick succession, after 40 bps in May and 50 bps in June. RBI governor Shaktikanta Das has rolled back all cuts during the pandemic and taken rates back over the pre-pandemic level. A 50-basis point, or half-a-percentage point increase in the home loan rate will inflate the EMI on a 20-year Rs 1 crore home loan by Rs 3,085 from Rs 80,559 to Rs 83,644.

Repo rate is the rate at which the central bank lends money to banks and is the benchmark for nearly 40% of the loans, which will result in automatic readjustment.

While the rate hike was on the higher end of market expectations, the RBI retaining its 2022-23 projections for both GDP growth (7.2%) and inflation (6.7%) helped calm sentiment.

The sensex closed 89 points higher at 58,387 while the rupee gained 23 paise to close at 79.24 after touching an intraday high of 78.94.

RBI’s rate hike comes when crude oil and international commodity prices have shown signs of softening amid fears of a recession in the West. RBI’s action, however, appears to have been influenced by volatility in the rupee, which recently hit 80 to the dollar. RBI has expended over $40 billion of its reserves defending the rupee. With this hike, RBI has kept up with other central banks that have increased rates far more than in India.

Terming inflation above 6% as unacceptable, Das said India’s macroeconomic and financial sector stability and resilient growth gave RBI space to take action on rates.

RBI doubles home loan limits for co-op banks

With its latest revision, RBI has hiked the repo rate by 140 basis points since May 4 – the steepest increase in over a decade. Along with the repo rate, RBI also revised the standing deposit facility (SDF) to 5.15%. The SDF is a facility where banks park their surplus liquidity with the RBI.

To boost housing demand, which is likely to get dampened because of the increase in interest rate, the RBI has doubled the home loan limits for cooperative banks. The RBI has also allowed rural cooperative banks to provide loans to commercial real estate for housing projects.

The markets expected a rate hike between 35 and 50 basis points. Das said that domestic economic activity is resilient and progressing broadly along the lines of the June resolution of the MPC. Consumer price inflation has eased from its surge in April but remains uncomfortably high and above the upper threshold of the target. Inflationary pressures are broad-based, and core inflation remains at elevated levels

Repo rate hike to hit existing home loan borrowers harder

Increase in repo rate by 1.4 percentage points in the last three months has affected prospective homebuyers. And, it has hit existing ones even harder as they have limited elbow space to negotiate a better deal.

The RBI increased repo rate by 90 basis points (100bps = 1 percentage point) in two tranches – in May by 40bps and in June by 50bps. Many banks have also increased their rates on similar lines.

Repo rate is the rate at which the central bank lends money to banks. For existing borrowers, home loan rates will increase equal to increase in repo rate as their rates are directly linked with it. But new buyers borrow at rates fixed by banks, adjusting for hike in repo rate. Increase in new home loan rates are lower than total increase in repo rates.

SBI increased its rate for the best of the customers from 6.65% per annum in April to 7.55% before the latest hike in repo rate by 50BPS on Friday. Similarly, other banks also increased rates proportional to hike in policy rates.

But, many banks absorb parts of the cost associated with increase in policy rates due to competition. The cost of funds for banks is dependent on deposit rates. But, most banks have not increased deposit rates to keep pace with increase in repo rate.

According to RBI data, interest rates on term deposits of more than one year were between 5% and 5.6% in April 2022, which increased to between 5% and 5.75% in July, during which the RBI increased repo rates by 90bps. Many banks did not increase lending rates to match increase in policy rates due to this reason. Instead, banks like Indian Overseas Bank increased its home loan rate to 7.05%, Central Bank of India to 7.2%, Bank of India and Bank of Maharashtra to 7.3% by July 2022 from around 6.6% in April 2022.

As the home loan rate for existing borrowers had already increased by 0.9 percentage points before Friday’s increase of 50bps, their EMI has risen by 11% from April. If the repo rate further increases, as expected, by another 50bps in the September review, the total increase in EMI for existing borrowers would be 15.5%, which is high for already financially overstretched homebuyers.

Industry players say the hike will affect the real estate sector badly. As home loan borrowing is at flexible rates, a short-term interest rate spike will hurt homebuyers’ sentiments, said Niranjan Hiranandani, MD, Hiranandani Group.

[ad_2]

Source link