Hyatt Hotels: Strong Positioning Amidst The Summer Travel Splurge

[ad_1]

Marko Geber/DigitalVision via Getty Images

Hyatt Hotels Corporation (NYSE:H) is reemerging stronger after suffering from pandemic disruptions. Its portfolio is now well-positioned, matched with its prudent expansion, investments, and divestitures. Its transition to a fee-based model allows it to optimize more opportunities. Also, revenge leisure travel and increased business travel may help sustain its growth.

Meanwhile, pandemic disruptions still exist, intensified by the high price levels. Even so, it can thwart the blow with its larger operating capacity and higher liquidity. That is why it is no surprise that its stock price adheres to the bullish market trend. The price remains attractive and lower than the estimation in my previous article.

Company Performance

Hyatt Hotels Corporation has become more robust in the second quarter. Both quarters showed its continued and sustained recovery from their rock-bottom in 2020-2021. Although it is still coping with the massive changes, it has a strong market positioning. In the last two years, it has struggled to capture demand amidst limited operations. But now, its rebound and growth prospects are more visible and attractive.

Amidst the Covid-19 and Monkeypox fears, revenge travel remains strong. Inflation does not lead to a massive reduction in leisure and business travel. Americans and Singaporeans are not geared towards travel and leisure cancellations. Last month, there was an 8% increase in summer travel. The hot season is still at its peak while inflation seems to be in a summer lull at 8.5% from 9.1% in June.

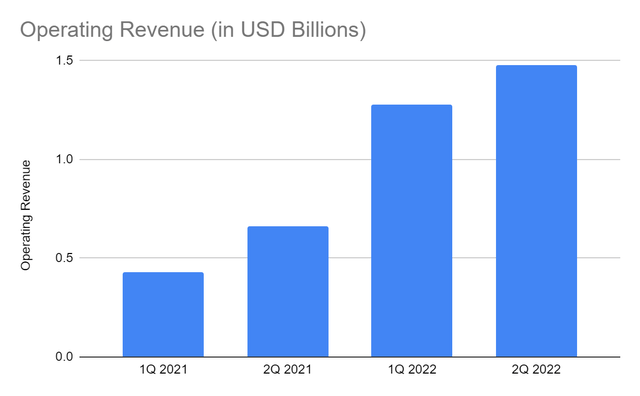

The operating revenue amounts to $1.48 billiona 124% year-over-year increase. It is 16% higher than in 1Q 2022. We can say that the quarterly increase is seasonal. But, we have to consider the massive increase in prices. Despite the inflation and pandemic fears, travel plans continue to heat up. Its recent RevPAR continues to accelerate, which is already higher than pre-pandemic levels. It is also higher than the value in my previous article.

Operating Revenue (MarketWatch)

The primary growth drivers remain almost the same. It combines the influx of demand with its larger operating capacity. The addition of Apple Leisure Group (‘ALG’) allows the company to cater to more travelers. It comprises 24% of the total revenues. Although its percentage is lower than 26% in 1Q 2021, the value is still higher. It just shows that the main company is speeding up even more. Even without ALG, Hyatt itself continues to make a rapid recovery and sees growth.

Moreover, its adoption of a fee-based business model improves its market positioning. Its management and franchise fees comprise 14% of revenues vs 12% in 1Q 2022. It is more efficient, raising revenues while keeping costs and expenses manageable. Sales turnover is faster, allowing it to set more flexible and favorable pricing.

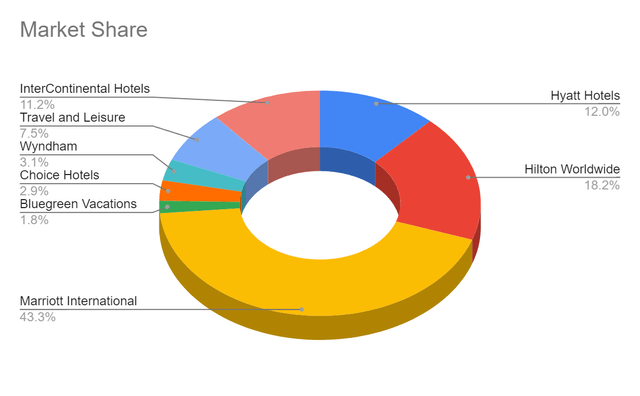

Relative to its closest peers, its revenue growth appears to be higher than the market average. Of course, it will still take more time and effort to be as massive as Marriott (MAR) and Hilton (HLT). These giants have over one million rooms, so H is less than half way on its journey. Even so, its path remains smooth, matched with its continued expansion. Currently, it has 290,987 rooms, which is 21% higher than in 2Q 2021. It is also 2% higher than the total number of rooms in 1Q 2022.

Market Share (MarketWatch)

It holds 12% of the market share vs 8.4% in 2Q 2022. Amidst the substantial demand increase, more growth prospects are evident. With its larger market visibility, it may capture a larger number of travelers. It is possible, given its increased capacity to set prices as inflation slows down. It may use this opportunity to set more competitive but reasonable prices.

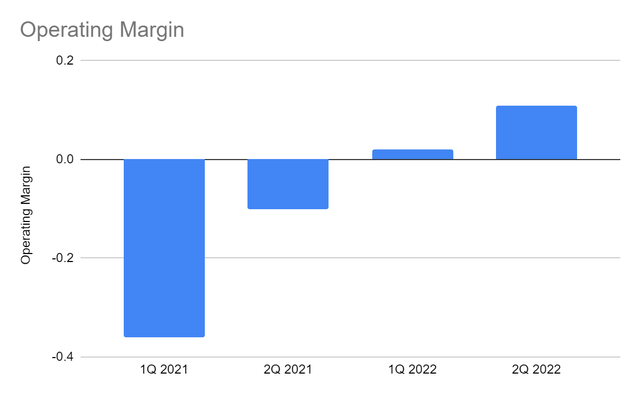

Even better, its efficiency is no longer lagging behind its peers. Its operating margin of 11% is way higher than in 1Q 2022 at 2%. Thanks to the huge demand increase, helping it to observe higher RevPAR. Also, the adoption of a fee-based business model is speeding up and paying off. This more efficient business model leads to more stable costs and expenses amidst inflation. As discussed, pricing is more flexible and competitive to offset higher costs and expenses. It appears to be more viable, which helps it sustain its expansion.

Operating Margin (MarketWatch)

Potential Opportunities and Hurdles

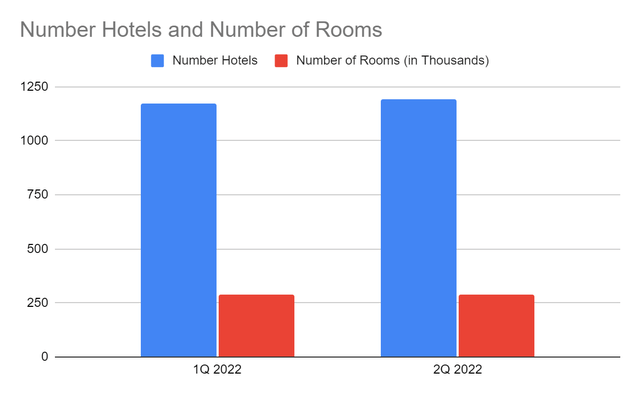

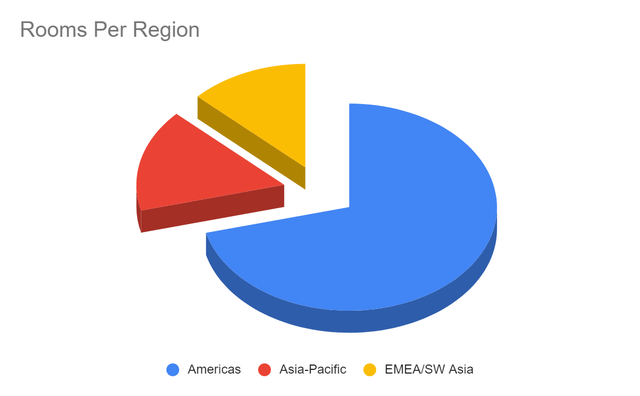

Hyatt is well-positioned for these market opportunities. Its sustained expansion and new business model will allow it to accommodate more guests. It has 1,194 hotels vs 1,172 in 1Q 2021 with 71% of hotel rooms located in the Americas vs 68% in 1Q 2022. It is an excellent decision since the US, Canada, and Mexico are among the top ten summer travel destinations in 2022. Also, Americans may spend almost $200 billion on summer vacations.

Number of Hotels and Number of Rooms (2Q Financial Report)

Rooms Per Region (2Q Report)

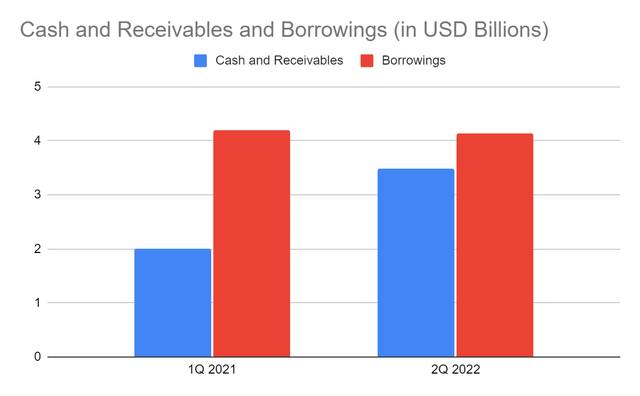

Moreover, Hyatt has a massive capacity to sustain its larger operations. In my previous article, liquidity is one of the things I was concerned about. Now, its liquidity position is excellent with its stellar Balance Sheet. Its financial leverage is more stable with higher cash and receivables. From 47% in 1Q 2022, the percentage of cash and receivables to borrowings is now 84%. Its Net Debt/EBITDA is 3.53x, which is within the ideal range of 3-4x. So, Hyatt earns enough to pay its borrowings.

Cash and Receivables and Borrowings (MarketWatch)

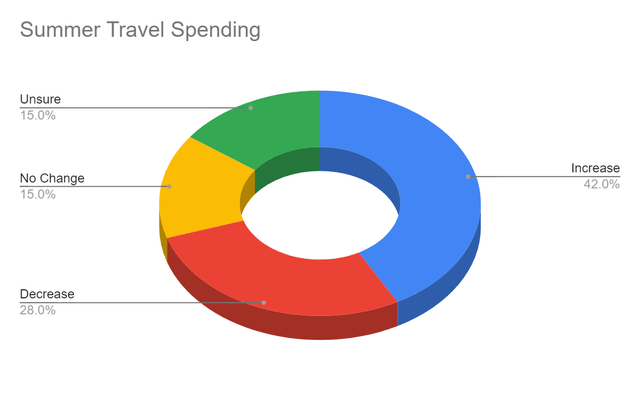

Yet, the resurgence of the pandemic in different areas remains a hurdle to the recovery of the accommodation industry. Inflation intensifies it as it may affect travel spending. Over 50% of travel plans changed due to higher costs and pandemic fears. Initially, travelers planned to spend $1,636 for their summer vacation. Yet, 28% of them may decrease their travel spending to $1,000-1,400.

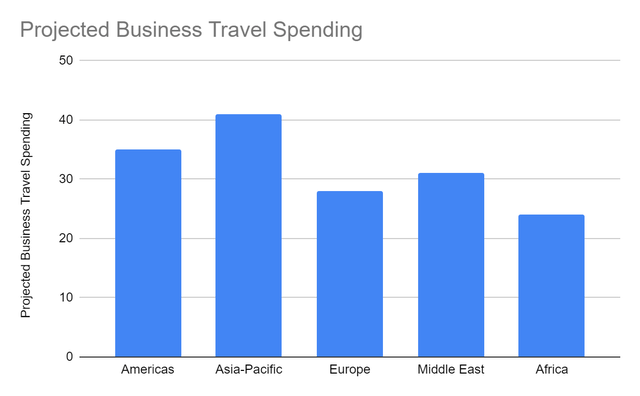

Nevertheless, nothing can stop the summer travel splurge. Travel cancellation remains out of the question for many. About 42% of travelers say they will spend more on summer travel. Another recent study shows that 68% plan to take a summer vacation no matter what. The business travel boom is also evident with spending increases across different regions.

Summer Travel Spending (Forbes)

Projected Business Travel Percentage Increase (hospitalitynet)

Stock Price

The stock price of Hyatt Hotels Corporation is in an uptrend. At $94.13, it is 32% higher than its most recent dip The bearish trend was evident, and there was a better entry point before making a position. I also expect a rebound, given the potential summer travel splurge. That is why my advice then was to hold. The lower price range persisted from mid-June to the last week of July. I hope readers followed my advice to not buy or sell at $93.49 in my previous article.

Amidst the uptrend, the P/E and P/B ratios show an overvaluation. Even so, the values are better than in my previous article. Meanwhile, Price/Cash Flow shows that it is still ideal. The current stock price is only 0.5% higher than the stock price in my previous article. To assess the stock price better, we will use the EV/EBITDA.

DCF Model

FCFF $288,000,000

Cash $1,480,000,000

Outstanding Debt $181,000,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 109,114,000

Stock Price $94.13

Derived Value $98.97

EV/EBITDA

EV $12,560,000,000

Net Debt $2,130,000,000

Common Shares Outstanding 109,114,000

Stock Price $94.13

Derived Value $96.58

The derived values of both models adhere to the attractiveness of the stock price. But, the difference from the current stock price is still low. There may be an upside of 3-5% in the next 18-24 months.

Bottomline

Hyatt Hotels Corporation is well-positioned for market opportunities and disruptions. It has sound financials with an impressive liquidity position. Also, the spillovers of a travel splurge and the slight inflation lull may help sustain the industry rebound. The stock price adheres to the solid fundamentals, but I suggest waiting for a better entry point. The recommendation is that Hyatt Hotels Corporation is a hold.

[ad_2]

Source link