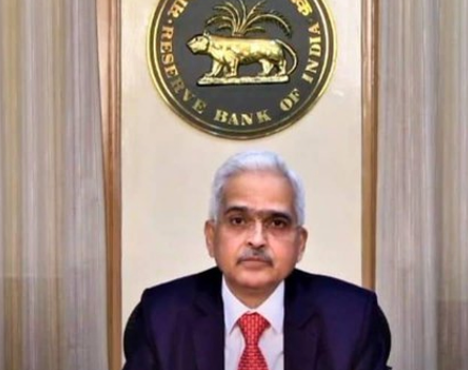

RBI Commitment to Protect Paytm Customers, Affirms Governor Shaktikanta Das

RBI Governor Shaktikanta Das Ensures Customer Protection

The Reserve Bank of India (RBI) has taken a firm stance to safeguard the interests of Paytm Payments Bank customers, with a recent decision to prohibit all deposits or credit transactions in customer accounts starting from March 1, 2024. Governor Shaktikanta Das reiterated the central bank’s unwavering commitment to customer protection during a media briefing in New Delhi on Monday, underscoring that there will be no reconsideration of this directive.

Das emphasized the meticulous process preceding any regulatory decision, involving extensive consultations and thorough analyses. He clarified the absence of any plans to revisit the restrictions imposed on Paytm Payments Bank, a move prompted by longstanding concerns and culminating in the RBI’s directive on March 11, 2022, to halt the onboarding of new customers.

In light of the recent developments, the RBI’s decision on January 31, 2024, to bar Paytm Payments Bank Ltd (PPBL) from engaging in deposits, credit transactions, or top-ups as of February 29, was reinforced. Recognizing the need for a smooth transition, the central bank provided a grace period of one month to PPBL customers to facilitate any urgent transactions linked with the payment bank.

Addressing apprehensions among Paytm bank customers, Governor Das disclosed the forthcoming release of a comprehensive FAQ document aimed at addressing their concerns. This initiative seeks to alleviate any inconveniences encountered by depositors, customers utilizing the wallet services, and FASTag holders. Reiterating the RBI’s unwavering stance, Das reiterated that there are no contemplations on revisiting the current regulatory measures.

Effective March 1, 2024, all deposits or credit transactions will be barred in Paytm bank customer accounts, while allowances will be made for interest accruals, cashbacks, and refunds. Customers retain the ability to withdraw funds or utilize their existing account balances, ensuring continued access to their finances.

Governor Das reaffirmed the RBI’s support for the fintech sector while underscoring its paramount responsibility to safeguard the interests of millions of customers and depositors. Meanwhile, Paytm’s response to inquiries remains pending, with the company opting to reassure its customers through email communications. Assuring the safety of their funds, Paytm assured customers of uninterrupted access to withdrawals while clarifying the restrictions on deposits or additions to accounts post-February 29, 2024.

In summary, the RBI’s resolute measures aim to fortify customer confidence and ensure the stability of the financial ecosystem, underscoring its unwavering commitment to customer protection amidst evolving regulatory landscapes.

These regulatory actions underscore the RBI’s unwavering commitment to maintaining financial stability and fostering trust in the banking sector. Governor Shaktikanta Das’s assurance of no reconsideration reflects the central bank’s confidence in the necessity and efficacy of the measures taken.

The decision to restrict Paytm Payments Bank’s activities stems from a history of scrutiny and concerns regarding compliance and customer protection. By halting new customer onboarding and now limiting deposit and credit transactions, the RBI aims to address these concerns decisively.

Despite the restrictions, the RBI remains supportive of innovation in the fintech sector. Governor Das reiterated this stance, highlighting the importance of balancing innovation with the protection of customer interests. This signals a nuanced approach to regulation, one that seeks to foster a vibrant fintech ecosystem while upholding regulatory standards.

The forthcoming release of a comprehensive FAQ document is a proactive step by the RBI to address customer concerns and provide clarity amidst the regulatory changes. By directly engaging with customers and addressing their queries, the central bank aims to mitigate any potential disruptions or uncertainties.

Customers of Paytm Payments Bank have been reassured of the safety of their funds and continued access to withdrawals. Paytm’s communication to its customers underscores the importance of transparency and clarity during periods of regulatory transition. By proactively informing customers about the impact of regulatory changes on their accounts, Paytm seeks to maintain trust and confidence in its services.

Looking ahead, the RBI’s regulatory actions will likely prompt introspection and adaptation within the fintech industry. Firms will need to prioritize compliance and customer protection to navigate the evolving regulatory landscape successfully. Ultimately, these measures are aimed at strengthening the resilience of the banking sector and safeguarding the interests of customers, ensuring a stable and secure financial environment for all stakeholders.

For the latest updates-click here.